introduction5 Critical Oil and Gas Industry Challenges Reshaping Operations in 2026

The oil and gas industry has always operated in cycles. Commodity prices rise and fall. Regulatory frameworks tighten and occasionally loosen. Technology evolves, creating new opportunities and rendering old approaches obsolete.

What makes the current environment different is the convergence of multiple pressures simultaneously. Operators face not just one dominant challenge but several interconnected ones that compound each other’s impact.

This analysis examines five oil and gas industry challenges that are fundamentally reshaping how operators approach their business. Understanding these challenges is the first step toward addressing them effectively.

Challenge 1: Restarting Production Is More Complex Than It Appears

When commodity prices crashed in 2020, operators across North America shut in thousands of wells. Now, as prices have recovered, bringing that production back online has proven far more difficult than simply reversing the shutdown process.

The Physical Reality

Wells that sit idle for extended periods do not simply resume production at previous rates. Reservoir conditions change. Downhole equipment degrades. Surface facilities require inspection and maintenance before restart.

According to the Canadian Association of Petroleum Producers, restart costs frequently exceed initial shutdown estimates by 30-50%. Some wells never return to pre-shutdown production levels, requiring operators to write down asset values.

The Workforce Challenge

The industry lost experienced personnel during the downturn. Retirement accelerated. Career changes became permanent. When operators needed to scale back up, the workers with institutional knowledge of specific fields and facilities were no longer available.

New hires require training not just on general operations but on the specific quirks of individual wells and facilities. This knowledge transfer takes time the market does not always provide.

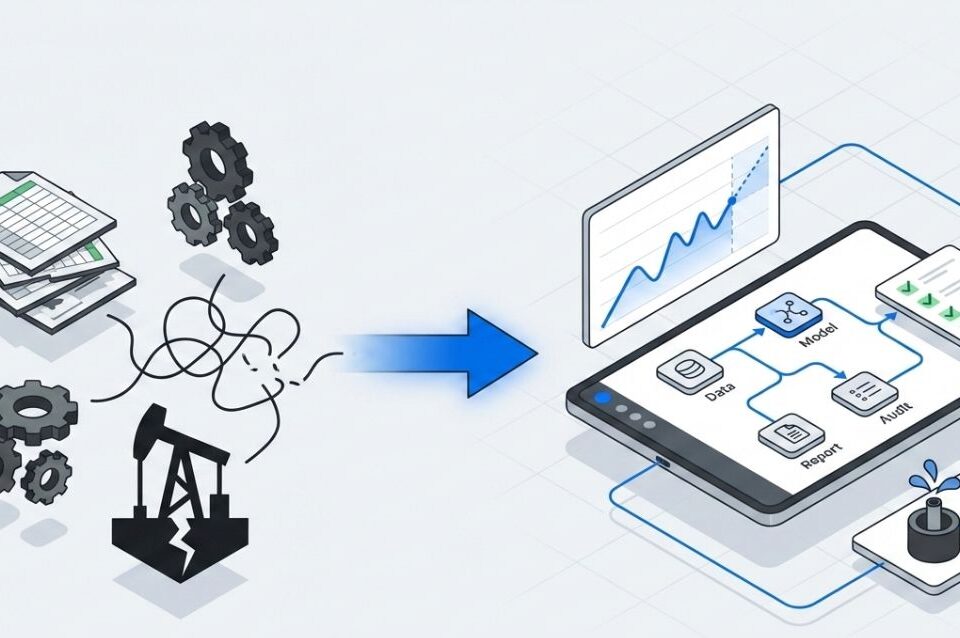

The Data Gap

Many operators discovered that their documentation of shut-in assets was incomplete. Production histories, maintenance records, and facility configurations were scattered across systems or existed only in the memories of departed employees.

Operators report spending weeks reconstructing basic asset information before restart planning could even begin. This experience has driven renewed interest in systematic asset management approaches that maintain documentation regardless of operational status.

Challenge 2: Regulatory and Environmental Pressures Keep Intensifying

The regulatory environment for oil and gas operations has never been static, but the pace of change has accelerated. Operators face expanding requirements from multiple directions.

Evolving Provincial Requirements

The Alberta Energy Regulator and equivalent bodies in other provinces continue updating compliance frameworks. Reporting requirements expand. Documentation standards tighten. Inspection protocols become more rigorous.

Operators describe compliance as a moving target. Systems designed for last year’s requirements may not satisfy this year’s expectations. The administrative burden of tracking regulatory changes and updating internal processes consumes resources that could otherwise support operations.

Environmental Remediation Obligations

Asset retirement obligations have emerged as a significant financial consideration. ARO forecasting now requires sophisticated modeling of remediation costs across portfolios that may include thousands of individual sites.

The liability management rating frameworks used by regulators create financial exposure for operators whose abandonment obligations outpace their ability to fund remediation. This exposure affects financing, acquisition opportunities, and strategic planning.

ESG Expectations

Beyond regulatory compliance, operators face growing expectations from investors, lenders, and business partners around environmental, social, and governance performance. These expectations translate into additional reporting requirements and operational constraints.

The practical impact extends beyond public companies. Private operators pursuing financing or exit transactions find that ESG documentation has become a standard due diligence requirement.

Challenge 3: Operational Inefficiencies Drain Resources

In a commodity business, operational efficiency directly impacts profitability. Yet many operators continue using approaches that introduce unnecessary friction and cost.

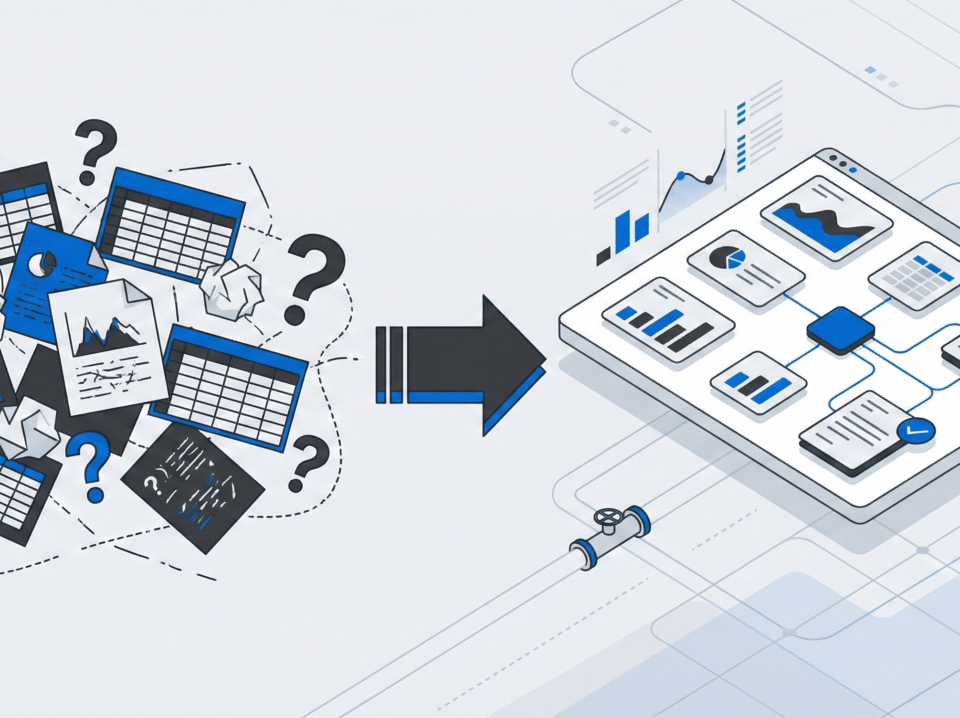

Fragmented Data Systems

The typical oil and gas operation manages data across multiple disconnected systems. Production data lives in one platform. Maintenance records in another. Regulatory filings somewhere else. Financial information in yet another system.

Jim Gordon, HSE Manager at Whitecap Resources Inc., describes the impact of this fragmentation: “Fieldshare means quick data input and quick data retrieval. It gives me the tools I need to monitor everything and drive KPIs.”

When data requires manual reconciliation across systems, errors multiply and decision-making slows. Operators report spending significant time simply locating and assembling information rather than analyzing it.

Manual Processes That Should Be Automated

Many operational workflows still rely on paper forms, spreadsheet-based tracking, and manual data entry. These approaches made sense when they were implemented but now create unnecessary overhead.

Organizations that have modernized these workflows report dramatic efficiency gains. Whitecap Resources Inc. achieved a 70% reduction in data management time after implementing centralized tracking systems.

Coordination Friction

Operations involve multiple parties: field staff, office personnel, contractors, regulators, and business partners. When these parties use different systems or incompatible processes, coordination requires extra effort that adds no value.

The most efficient operators have standardized how information flows between parties, reducing the overhead of inter-organizational coordination.

Challenge 4: The Energy Transition Creates Strategic Uncertainty

The global energy transition affects oil and gas operators regardless of their individual views on climate policy. Market dynamics, financing conditions, and competitive pressures all reflect transition realities

Investment Horizons Are Shortening

Lenders and investors increasingly question long-duration oil and gas investments. Projects with 20-year payback horizons face scrutiny that shorter-duration investments avoid.

This shift affects capital allocation decisions across the industry. Operators must generate returns more quickly or accept higher financing costs for longer-duration projects.

Asset Values Face New Scrutiny

The concept of stranded assets has moved from academic discussion to practical consideration. Regulators, auditors, and investors now expect operators to demonstrate that asset valuations account for transition scenarios.

This scrutiny affects acquisition decisions, financial reporting, and strategic planning. Operators need defensible documentation of asset conditions and production potential.

New Competitors Emerge

The energy transition is not simply a threat to oil and gas operations. It also creates new competitive dynamics as operators diversify into renewable energy, carbon capture, and other transition-adjacent activities.

Operators that develop capabilities in these areas may find new opportunities. Those that do not may face increasing competitive pressure as the energy mix evolves.

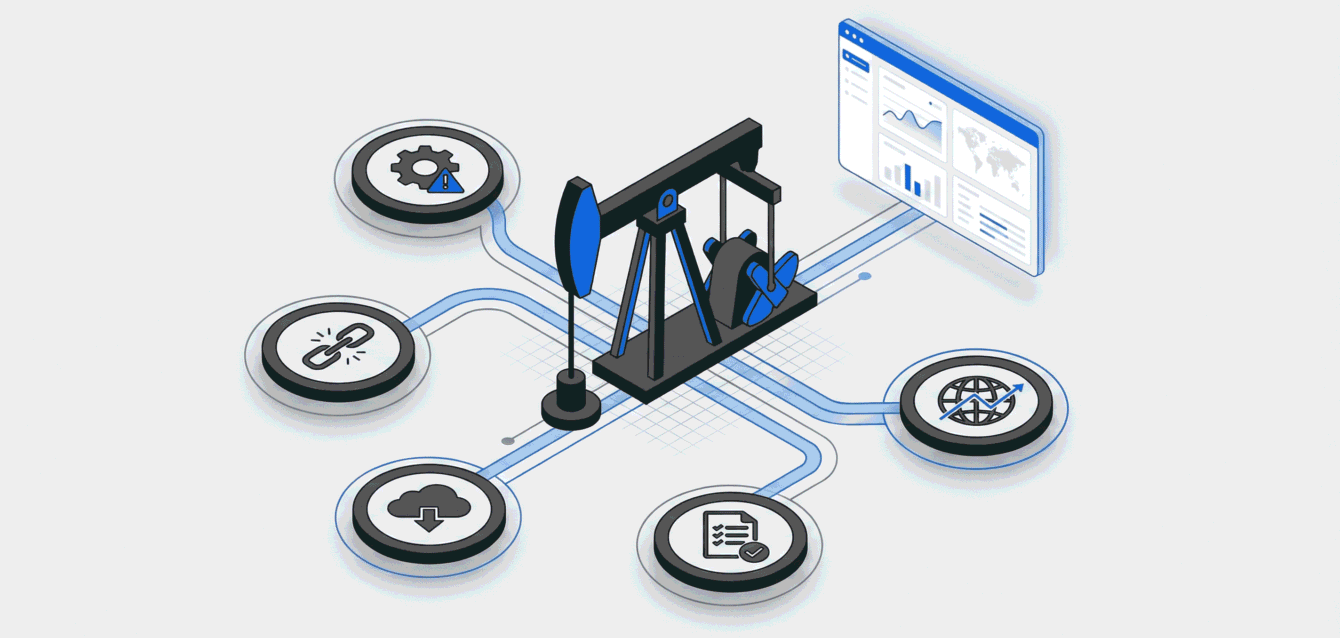

Challenge 5: Digital Transformation Remains Incomplete

The oil and gas industry has invested heavily in digital technology, but many operators have captured only a fraction of the potential value.

Technology Adoption Is Uneven

Large operators have implemented sophisticated digital systems across their operations. Smaller operators often continue using basic tools that limit visibility and efficiency.

This unevenness creates competitive dynamics. Digitally advanced operators can respond faster to market changes and operate more efficiently than those relying on legacy approaches.

Integration Gaps Persist

Even operators with modern systems often struggle to connect them effectively. Production monitoring systems do not talk to maintenance management systems. Field data collection does not integrate with regulatory reporting.

These integration gaps mean that data collected in one context must be manually transferred to other contexts, introducing delay and error.

Change Management Challenges

Technology implementation is often easier than organizational change. Operators invest in systems that deliver value only when people actually use them consistently.

Successful digital transformation requires not just technology but training, process redesign, and ongoing reinforcement of new working methods.

conclusionMoving Forward

These five oil and gas industry challenges share a common thread: they all create demands for better information management. Restart planning requires complete asset documentation. Regulatory compliance requires systematic tracking. Operational efficiency requires integrated data. Strategic planning requires defensible analysis.

Operators who address their information management foundations position themselves to handle whatever specific challenges emerge. Those who continue with fragmented, manual approaches will find each new challenge harder to address than the last.

The question is not whether these challenges will affect your operations. They already are. The question is whether you are building the capabilities to respond effectively.

Looking to improve how your organization manages operational data? Contact our team to discuss how integrated data management supports better responses to industry challenges.